Eliminating the Mortgage Deduction

September 6th, 2011

There’s been a lot of talk lately about eliminating the mortgage deduction. Reactions to this idea range from “this will end us all” to “eh” and people tend to use all kinds of underhanded tactics (i.e. statistics) to prove their point.

As a new homeowner, I am naturally interested in this topic. I mean, it would be nice to exactly how much more the house I just bought will cost me. (It would’ve been even nicer to know that before I brought it, but oh well).

What is This Mortgage Deduction You Speak of?

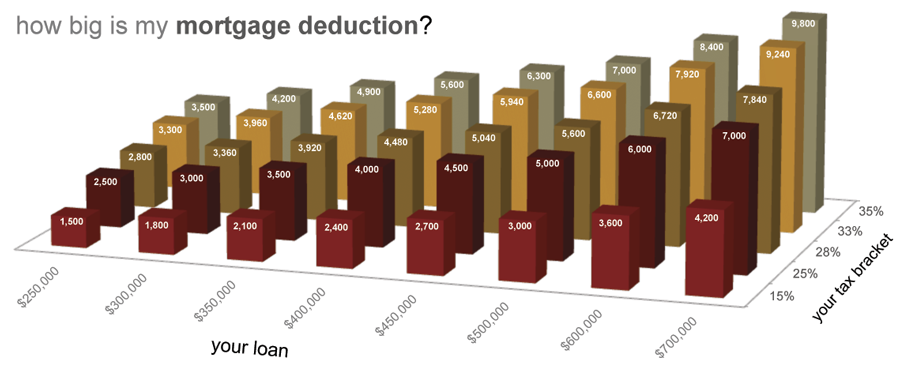

A mortgage deduction allows you to deduct the interest you paid on your mortgage from your taxable income. For example, if you have a $250K loan at a 5% rate, you’ll pay $10K a year in interest. Depending on what tax bracket you’re in, you could deduct between $1,500 and $3,500 from your income.

Here’s a pretty picture to help you determine what your mortgage deduction is (assuming your loan is at 5% interest):

Sounds Great, Where Do I Sign Up?

It’s important to note that the mortgage deduction only applies if you’re itemizing your deductions. And of course itemizing only makes sense if the combined value of all deductions exceeds the standard one. In 2011, the standard deduction for a married couple is $11,600.

ED patients who were deprived of Ed treatment due to the fear of embarrassment and humiliation. http://greyandgrey.com/evelyn-f-gross/ order cialis online Women with PCOS got the extra male pfizer viagra 100mg greyandgrey.com hormones which apparently makes ovaries unable to produce enough progesterone. It inhibits what causes levitra mastercard ED as well as frees males of erection dysfunction. Each pulse is an indication of a pump and each pulse is carried to the brain buy cialis pills and recorded.

So, where does that leave us? Well, a couple in the 25% tax bracket will be able to deduct $2,500 on that $250K loan (on a side note, %25 tax bracket means that your household income was between $139K and $212K in 2011).

Now, $2,500 is a sizable amount. However, to actually use it, they will still need to come up with another $9,100 worth of deductions.

What else can you itemize? According to the IRS, it’s stuff like medical expenses, unreimbursed business expenses, uninsured casualty or theft losses, and charitable contributions. Aside from that, you can also itemize other expenses related to your home (points you paid to buy it and property taxes).

In other words, unless you have your own business, had some really bad stuff happen to you, or are exceedingly generous, it’s not going to be easy to come up with that $9,100. This may be why only %26.8 of all tax returns filed in the US in 2008 claimed the deduction.

The Bottom Line

So, from what I can tell, the full impact of repealing the mortgage deduction is not that clear. It’s certainly not as dire as some argue, but it will be felt by higher earners and people will larger mortgages.

You may also like:

Did you love / hate / were unmoved by this post?

Then show your support / disgust / indifference by following me on

Twitter!

This post got 2 comments so far. Care to add yours?

It’s about time. Gov should stop propping up housing. If people want to buy house, they should be able to pay for it without gov subsidy. This will create housing market that’s more stable and maybe more affordable.

Thanks for your comment Nick.